The aroma of rich coffee wafts through the air as Xolile Malindi leans behind the counter of House of Machines, a hip café in the heart of Cape Town. Opposite him, a young customer approaches the bar, taking his wallet out to pay for his double espresso made of organic Arabica beans.

“Have you ever heard of this program called the SnapScan?” Malindi, who is the coffee shop’s day manager, asks quickly. “You pay with your phone,” he continues. “A lot of places are using it in Cape Town — it’s quite amazing.”

House of Machines is just one of dozens of stores where customers can find SnapScan, an award-winning new digital mobile payment method developed in South Africa.

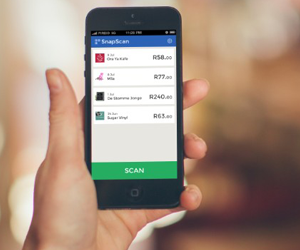

The smartphone app, free to download, allows buyers to pay for goods using their phone, without having to worry about carrying cash or credit cards.

Each SnapScan-connected store has a unique code that is linked to their bank account.

When customers want to pay, they can scan the code with their SnapScan smartphone app, which then brings up the store where they are making the purchase.

“All you do is you type in the amount and punch in the PIN and press send and it’s gone — it’s all done,” explains Malindi. “You’ve got your secret code, so if your phone goes missing for example, you don’t have to worry about people using your phone.”

The transaction is complete with SnapScan charging the customer’s debit or credit card for the amount they are paying – similar to a normal card payment.

Using your phone to pay for goods and services is nothing new in Africa, where there are more than 720-million mobile phones.

Services such as M-Pesa, the revolutionary Kenyan mobile payment system that allows people to bypass banks and pay bills, withdraw salaries and transfer cash electronically, have transformed the way people and businesses operate.

Meanwhile, Africa’s smartphone market is expected to double over the following four years — at the moment, South Africa is reportedly the biggest smartphone market in sub-Saharan Africa, with a 19% penetration.

And as smartphones increase, the paying methods are also becoming smarter.

“If you look at mobile payments specifically, Africa is actually one of the leaders in this space,” says Kobus Ehlers, co-founder of the SnapScan app. “SnapScan was developed in South Africa for the African market, so we try to find really local and relevant solutions and I think it’s going to get a massive uptake,” he adds.

Right now, SnapScan is only available at formal merchants but the hope is that the e-currency could flow from the phones of customers to the accounts of informal merchants too. It can even be used to send remittances.

“Quite a large portion of people have access to a smartphone and by leveraging that technology we can provide payments that were previously impossible,” he says. “That really is an empowering thing for most people in Africa who haven’t got access to formal infrastructure to provide those services.”

John Campbell heads up the Beyond Payments division of Standard Bank, which partners with innovators such as SnapScan to create banking solutions. He says that lack of traditional infrastructure often leads to creative solutions.

“In other territories where that infrastructure was not available, that infrastructure has been leapfrogged by the use of mobile,” explains Campbell. “M-Pesa in Kenya is a good example of that, where money goes straight to your mobile – your mobile number almost becomes your account number, that’s effectively what happens.”

Back in the House of Machines, Malindi keeps on introducing the new payment method to his customers.

“It’s way better as opposed to using your credit card or cash,” he says, adding that he was surprised to find out that SnapScan was a tech company that started in South Africa.

“I thought it’s one of the things that we get from overseas,” says Malindi. “When I found out this is African-launched I was ‘wow, here we go Africa, here we come, we’re rocking the world!’”

http://edition.cnn.com/2014/02/20/business/no-cash-no-cards-just-smartphone/index.html?hpt=iaf_mid

Leave a Reply